Cameco Stock: Great Outlook, Future Growth Is Priced In (CCJ)

JacobH

investment thesis

Uranium is making a global comeback because it first provides base-load energy and, second, it is compatible with reducing CO2 emissions. In addition, global reserves will last for about 90 years, which is longer than many other minerals. cameco (NYSE:CCJ)(TSX:CCO:CA) is one of the world’s largest producers of uranium. In this article, I want to examine the future outlook and how much of the projected potential is already priced in. Overall, this article is much more about the general uranium sector than Cameco since the company’s profits depend highly on the uranium price development.

Industry Overview

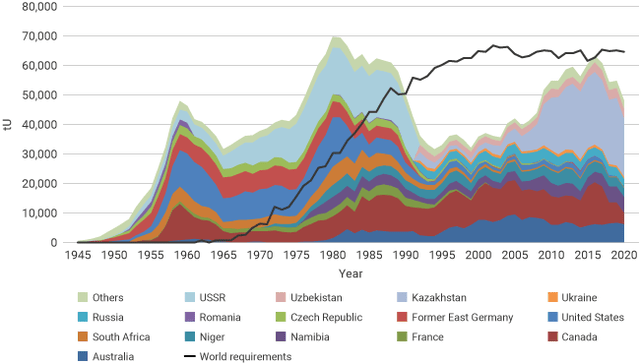

Global uranium production is highly consolidated. In 2021, only ten companies produced 90% of the world’s demand. The world’s largest uranium producer is Kazatomprom from Kazakhstan (listed on the London stock exchange). According to the World Nuclear Association (WNA), the demand for uranium has been stagnating since 2000 (which was also due to efficiency improvements in nuclear power plants). At the same time, global production has been below demand since 1990. How is this possible without prices exploding?

World Nuclear Association

“Mid-1980s to about 2002. By 1985, the nuclear construction program had been cut back severely. Many utilities had signed uranium contracts in anticipation of building more plants. Honoring these created a significant overhang. As mines were being run down, many cut production or closed. Utilities satisfied requirements by drawing down their significant inventories, without recourse to new production. The supply overhang was extended due to the arrival on the Western market of uranium from the former Soviet Union starting in 1993.” – World Nuclear Association

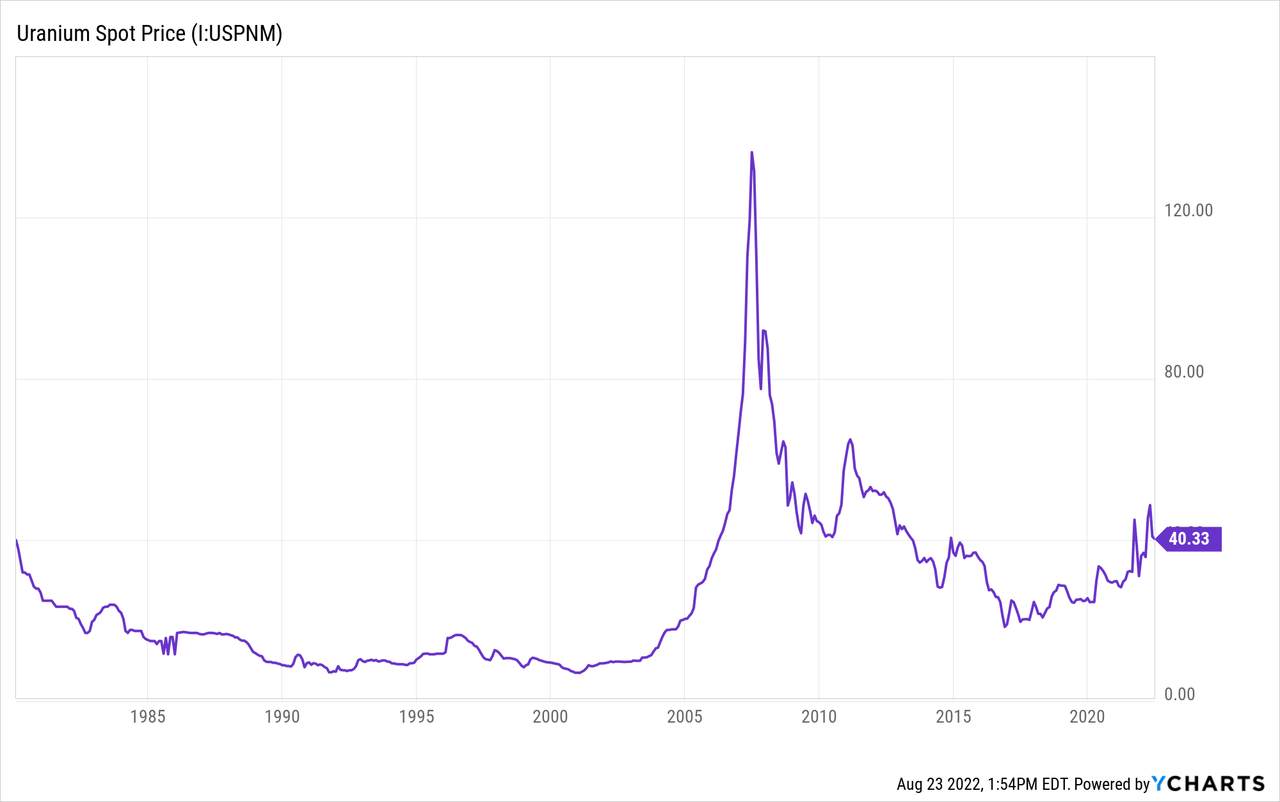

So there were significant stockpiles. But since 2000, we see uranium production increased, until in 2015 global production and consumption were in line again. Since then, however, production has declined again, mainly because of Fukushima, resulting in meager uranium spot market prices. Companies could no longer produce profitably. Adjusted for inflation, these were the lowest uranium prices of all time.

Uranium Spot Price data by YCharts

Uranium Spot Price data by YCharts

The uranium market has a lot of catalysts

Overall, it can be said that global production is still below consumption, while full stockpiles have been reduced more and more since 2000. According to WNA, world reserves today are about 282,000 tons, with a consumption of 68,000 tons annually. But they mention that reserves must always remain at a certain level to ensure the energy security of individual countries.

At the same time, uranium prices are still extremely low in historical comparison and adjusted for inflation. Furthermore, 51 nuclear power plants are currently under construction (with 442 in operation). So this alone will increase demand by another 10-15%.

About 90 power reactors with a total gross capacity of about 90,000 MWe are on order or planned, and over 300 more are proposed. Most reactors currently planned are in Asia, with fast-growing economies and rapidly-rising electricity demand.

Source – WNA

With this rapid expansion, it cannot continue forever that the global supply is below the demand. And then, we will experience what can currently be observed in other energy sectors – too little supply leads to sharply rising prices.

Cameco’s history

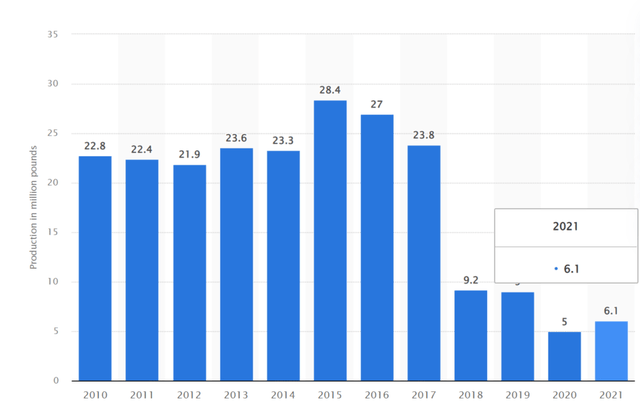

If you look at the production in Canada in the first chart above, you will see that it has fallen particularly sharply. That’s Cameco’s production decline visualized. They completely shut down the McArthur River Mine in 2018, which was the world’s largest mine in 2012 and alone produced 13% of the world’s uranium. It is also home to over 50% of Cameco’s reserves. In 2021, Cigar Lake was the world’s largest single mine, and Inkai is a joint venture with Kazatomprom located in Kazakhstan.

| mine | Reserves in million pounds | Cameco’s share |

|

Cigar Lake |

152 | 76 |

|

McArthur River |

394 | 275 |

|

inca |

281 | 112 |

Click to enlarge

How long will their reserves last?

Above in the first paragraph, I wrote that uranium is so attractive because the world’s reserves will last another 90 years. But what about Cameco?

The total reserves are about 463 million pounds. Cameco states these as “proven & probable”. Therefore, we can’t be sure that this number is exact, and usually mines are not mined down to the last bit in an economically lucrative way. Therefore, I find it appropriate to subtract 10% from this figure as a margin of safety. This leaves approximately 417 million lbs.

extra

The chart above shows their annual production in million lbs. Here we see the disappearance of the McArthur River in 2018. So last year, they produced 6.1 million lbs, which could go on for 68 years with 417M reserves. Cameco’s plan for the Cigar Lake mine is to produce about 9.5M lbs in 2022, which would mean that at this rate the mine would be mined out in 8 years (remember, this mine accounted for almost 10% of global uranium production in 2021) .

However, the company does not want to stay at 6M lbs of production. Recently, they gave insights into the production 2022 and realized prices.

We now expect to deliver between 24 million and 26 million pounds of uranium this year (previously between 23 million and 25 million) as a result of some additional in-year deliveries. With the additional deliveries in 2022 and increased sales/delivery commitments in 2023, we expect to purchase between 14 million and 16 million pounds in the uranium segment this year (previously between 12 million and 14 million pounds) in order to maintain a working inventory. As a result of the movement in the uranium spot price in recent months, we have updated our outlook for the anticipated uranium realized average price to $56.60 per pound (previously $58.60 per pound).

Q2: Management’s discussion and analysis

If I understand this correctly, 25 million pounds is being produced, but due to purchases of assets, the actual outflow is about 10 million lbs. Of course, there are many variables here. Maybe more will be discovered, and perhaps more mines will be bought in other countries. Another possibility is to increase the ownership in existing mines (as happened at Cigar Lake recently).

Overall, it can be said that production at the lowest end of the estimate can continue for about 17 years. More realistic, however, are at least 25 years, rather more.

Recent results

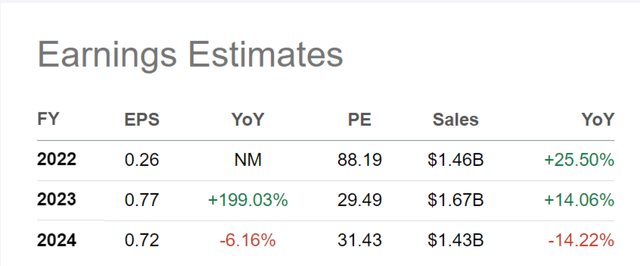

With that foreknowledge, we can now look at some financials. The recently unveiled Q2 numbers were much better than expected, with $0.14 EPS instead of the $0.01 expected. Revenue was also a full $175M above expectations at $558M. The realized prices for uranium were 41% higher than last year.

Seeking Alpha

It looks like the 2022 earnings estimates will be significantly beaten. But even at, for example, $0.38 EPS, the stock is not cheap. The P/E ratio would then be 61. This means that much of the previously described market dynamics in the uranium sector are already priced in.

I noticed something interesting in their 2022 outlook. Only 2.8 million lbs were produced in Q2, but 7.6 million lbs were sold. So they sold quite a bit from their inventory. The realized price was $46.2 per lb, which is higher than the current spot price. So the realized price could go down in Q3, depending on how the uranium price continues to develop.

7.6 million lbs in one quarter would be an annualized 30 million (more than the target of 25 million). So even the high volume in this quarter only resulted in $0.14 EPS, which sounds quite alarming. You have to do a lot of math to end up with EPS high enough that the P/E ratio doesn’t seem very expensive anymore.

dividend

The dividend is currently almost non-existent at $0.09 per year. But I expect it to rise quickly as profits increase. But I would like to mention that the highest dividend ever paid was $0.40 (in 2011). Even that would yield only 1.7% on today’s share price. Let’s assume that profits explode and we even double that again, but we’re still only at 3.4%. For my taste, that’s too little for a company that mines and slowly sells its assets and will have nothing left in a few decades. There are many more attractive deals in the oil sector, some with incredibly high dividends (see my article on Petrobras).

Financially, the company is in good shape with $800M in debt and over $1.1B in cash.

Conclusion

In itself, the market environment for uranium is the perfect storm. I’d love the stock, but it seems we’re a bit late to the party. The stock is expensive, and even with higher uranium prices, I don’t think the stock will become cheap anytime soon. I want to be confident that my investments will produce a double-digit annual return. With commodity stocks, a significant portion of the return often comes from dividends, but with Cameco, I don’t see that happening anytime soon.

Ultimately, Cameco is a speculation on the uranium price. If one thinks the uranium price will rise by a multiple (and stay there), this could still be an excellent investment opportunity. But unfortunately, it seems impossible to predict where uranium will ultimately settle.

Comments are closed.