Generating Extra Income Using Covered Calls: Episode 1

imagedepotpro/iStock via Getty Images

investment thesis

I’ve recently written about two companies that I am bullish on, NuScale Power Corporation (SMR) and Photronics, Inc. (PLAB). As I disclosed in those articles (Photronics here, and NuScale here), I am long both of them. I have also written covered calls against these positions, pocketing the premium as a way to lower my net cost.

NuScale Power

As I argued in my recent article on SMR, the world’s demand for clean energy will continue to grow and nuclear power should be part of most countries’ energy mix, both for geopolitical energy security and for diversification. History has shown that fission reactors have been operated relatively safely and have led to far less harm to people and the environment than many people realize.

NuScale has taken a regulatory lead in the still developing Small Modular Reactor field by developing scalable power plants that should be easier to site and deploy than earlier generation large scale nuclear reactors. They have accomplished this by utilizing existing pressurized light water reactor technologies and existing nuclear fuels. Other companies are developing SMRs based on new, novel technologies which require much more validation and testing because of their inherent unknowns.

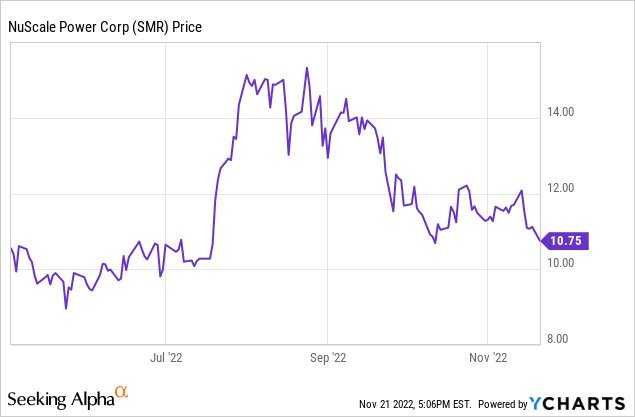

I have owned SMR stock (and it’s SPAC merger partner Spring Valley Acquisition Corp.) since last April. I have also written covered calls against the positions several times, with the latest ones expiring out of the money this past Friday, November 18. The $20 strike call options were sold when the stock was at about the same levels as today, or about $10.80 . So I am now evaluating which options to sell again.

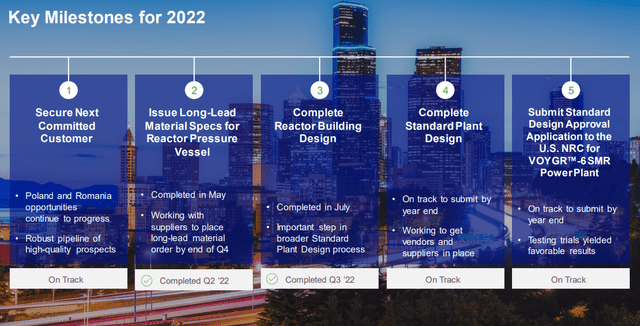

I want to own this stock for the next 3-5 years, but my near-term outlook for the company takes into account its limited current revenues and long lead times. As outlined in their recent earnings conference call, they are currently executing very well against their business plan and are on track to achieve start of operations at the Carbon Free Power Project with UAMPS in 2029, although this plan has also had cost overruns and delays in the past

NuScale 3Q22 Earnings Presentation

Because the company has laid out these milestones and roadmap, I doubt that even the positive news of signing another customer by year end would have too much of an effect as it should be anticipated and the company has been very transparent about where these efforts have been concentrated. Of course, any negative news regarding the UAMPS project would be pretty detrimental to the share price.

Given these factors and the risks in owning this early-stage company, I want to choose a strike price that provides significant upside, so I’m looking for out-of-the-money call options. I decided I would be happy if the stock recovered to its recent highs of $15+ by the May 19, 2023 expiration. 179 days left until expiration is a longer period than I typically like, but the limited volume makes shorter dated options so illiquid that upside calls have very low bids. If the stock moves up above the $15 strike price at expiration, this would still give an additional 39.4% upside for the stock if I allowed it to be called away. With no dividend, it would be unlikely for it to be exercised before expiration.

Data by YCharts

Data by YCharts

I did not pull the trigger on this trade today since the market and SMR stock were both down, but the May ’23 $15 Call option last traded at $0.50 ($0.40 bid / $0.65 ask with implied volatility of 65.89%), which amounts to about 4.64% of the underlying stock price, or 9.47% annualized.

Photronics, Inc.

Another company I recently covered is Photronics (PLAB), a manufacturer of photomasks used in the production of semiconductor chips and flat panel displays.

My thesis is that investors are not giving enough weight to tailwinds in the photomask market which are likely to result in tight supply/demand conditions persisting even if there is softness in overall semiconductor production. These tailwinds include past underinvestment in equipment to produce masks for more mature nodes, which have turned out to be in greater demand than the industry predicted. On top of that, there is also a trend towards greater numbers of customized chip designs which require new photomasks to produce. As a result, PLAB has been increasing its selling prices and negotiating longer term agreements with customers, leading to the strongest revenues and margins in the company’s history. The mask shortage will take several more years to resolve given the difficulty sourcing the equipment to make more mature node masks.

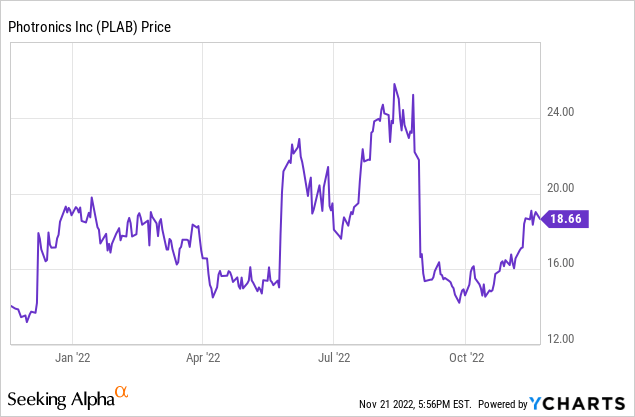

I plan to be in this stock for at least the next three years given these dynamics and its attractive valuation, as I more fully cover in the article cited above. The stock also has limited volume and in recent quarters has had strong post earnings moves in both directions. The company is expected to report its October 31, 2022 year-end earnings in the next couple of weeks, so the December 16’22 options have higher implied volatility and prices. I typically look to collect at least 1% of the underlying stock’s value in selling a shorter dated call, which would be at least $0.19 in this case. Again, I will likely try to wait for an up day to achieve an even better result, but the current December $22.50 strike last traded at $0.22 ($0.20 bid / $0.25 ask, implied volatility of 62.87%).

Data by YCharts

Data by YCharts

PLAB management gave guidance for the fourth quarter that disappointed some investors, but the stock has bounced off of those lows. As has been pointed out in the past, guidance tends to be conservative. I’m also eager to hear what management will do with the company’s growing cash balance. I believe that a strong report could propel the stock up through the $22.50 strike price.

If it does trade significantly higher, I will have to evaluate whether I want to roll my calls to a higher and longer dated strike price or let the stock be called away and wait for another entry point. Assuming I get the $0.22 for selling the calls, that represents 1.17% of the current share price, but with only 25 days to expiry is a 17.2% annualized return. Furthermore, the $22.50 strike price is 20.5% higher than where the stock closed today.

take away

In this article, I link two of my recent research reports to my predominant strategy of writing covered calls against my portfolio to generate enhanced returns.

Covered calls reduce the net cost of an investment strategy. Beyond that, however, they do not provide downward protection. Therefore, I carefully research the underlying companies and maintain the discipline of only doing buy/writes on companies that I am comfortable putting in my portfolio.

Please note that the annualized returns presented above are only illustrative. The prices of options change with many factors influencing their implied volatility. I cannot predict how stock-specific or market forces will influence how much premium I will be able to collect in the future on these investments.

Comments are closed.