Power-to-Power Hydrogen Demonstration Involving Largest U.S. Nuclear Plant Gets Federal Funding

Palo Verde Generating Station, a 4-GW nuclear power plant in Arizona, is gearing up to produce hydrogen from a low-temperature electrolysis (LTE) system, and that hydrogen will then be used to fuel a natural gas–fired power plant owned by Arizona Public Service (APS). The innovative power-to-power demonstration led by PNW Hydrogen is set to receive $20 million in federal funding, including $12 million from the Department of Energy’s (DOE’s) Hydrogen and Fuel Cell Technologies Office (HFTO) and $8 million from DOE’s Office of Nuclear Energy (NE).

The funding formally kicks off the demonstration, which will involve multiple stakeholders in research, academia, industry, and state-level government. On a federal level, that includes Idaho National Laboratory (INL), the Idaho Falls-sited laboratory that is becoming a central hot spot for nuclear integration research and development, as well as the National Energy Technology Laboratory (NETL), and the National Renewable Energy Laboratory. The Electric Power Research Institute, along with Arizona State University, and the University of California, Irvine will also collaborate on the project. These entities have been vocally supportive of the DOE’s June 7–launched Energy Earthshots Initiative, which aims to reduce the cost of clean hydrogen by 80% to $1 per kilogram (kg) over the next 10 years.

The project’s private partners will involve OxEon, a company that specializes in solid oxide fuel cells, and Siemens Energy, a gas turbine manufacturer that is heavily invested in decarbonized gas power and wants to produce heavy-duty gas turbines that are capable of combusting 100% hydrogen in volume by 2030. Siemens Energy, notably, is also a key stakeholder in HYFLEXPOWER, a European Union-backed four-year project to demonstrate a fully integrated power-to-hydrogen-to-power project at industrial scale and in a real-world power plant application.

Also notably involved is the Los Angeles Department of Water and Power (LADWP), a public power entity that in May 2021 outlined plans to convert four Los Angeles–area gas-fired power plants to run on hydrogen under the HyDeal LA project in coordination with the Green Hydrogen Coalition. That coalition, which comprises power companies, pipeline manufacturers, and financial firms, is currently working to put the necessary infrastructure in place.

Palo Verde is a three-unit 4-GW nuclear power plant located approximately 50 miles west of Phoenix, Arizona. Arizona Public Service operates the plant and owns 29.1% of Palo Verde Units 1 and 3 and approximately 17% of Unit 2. In addition, APS leases approximately 12.1% of Unit 2, resulting in a 29.1% combined ownership and leasehold interest in that unit. APS shares plant ownership with Salt River Project (17.5%), El Paso Electric (15.8%) Southern California Edison (15.8%), PNM Resources (10.2%), Southern California Public Power Authority (5.9%), and LADWP (5.7%). Courtesy: APS

‘Pink’ Hydrogen Could Demonstrate Nuclear Versatility

Because the Arizona demonstration is part of a larger nuclear industry-led effort to explore hydrogen’s future role for nuclear in renewables-saturated power markets, it will also involve input from members of a utility consortium, which are already working with INL on nuclear-hydrogen integrated systems. The consortium includes Energy Harbor, which in September 2019 kicked off a two-year project to demonstrate a 1- to 3-MWe LTE unit at its Davis-Besse Nuclear Power Station near Toledo, Ohio. It also includes Xcel Energy, which in October 2020 got $10 million to explore hydrogen production using high-temperature steam electrolysis likely at its Prairie Island nuclear plant in Minnesota. Though the consortium does not include Exelon, the company that owns the nation’s largest nuclear fleet is also exploring low-temperature proton exchange membrane (PEM) electrolysis at its Nine Mile Point nuclear plant in New York under a federal cost-shared agreement.

PNW Hydrogen’s involvement in the Arizona project is especially notable because its parent company, investor-owned corporation Pinnacle West, derives nearly all of its revenues and earnings from its principal subsidiary, APS. APS is the operator of Palo Verde, the three-unit nuclear plant that serves as a primary source of electricity for the southwest U.S. The utility owns 29.1% of Units 1 and 3 and about 17% of Unit 2 (it shares plant ownership with Salt River Project, El Paso Electric, Southern California Edison, PNM Resources, Southern California Public Power Authority, and LADWP).

While the company has planned to end all its coal generation by 2031 and rely on 100% “clean” power resources by 2050, it currently runs six natural gas power plants in Arizona. These include Redhawk, located near Palo Verde; Ocotillo, located in Tempe; Sundance, located in Coolidge; West Phoenix, located in southwest Phoenix; Saguaro, located north of Tucson; and Yucca, located near Yuma. APS has said that the consortium-led nuclear demonstrations are “expected to offer insights into methods for flexible transitions between electricity and hydrogen generation in solar-dominated electricity markets.”

“This project, and others like it, align with the mission of INL and DOE to sustain the existing fleet of operating light water reactors and support the pipeline of future advanced nuclear power systems,” explained Bruce Hallbert, director of DOE’s Light Water Reactor Sustainability Program, based at INL. “These projects demonstrate the versatility of nuclear power to meet the demands for energy and energy products while achieving reductions in carbon emissions to the environment.”

Demonstrating Nuclear Hydrogen for Peaking Power

Details about what the project will entail are still murky, however. Pinnacle West’s financial documents suggest the project is being rolled out in phases that are planned through 2023. As part of the first phase, INL has reportedly already “performed a technical and economic assessment of using electricity generated at Palo Verde to produce hydrogen.” Based on the experience from Palo Verde’s utility partners’ demonstration projects and from INL’s Palo Verde-specific technical and economic assessment performed, PNW Hydrogen submitted its request for funding to the DOE’s Office of Nuclear Energy for the pilot.

The DOE on Oct. 7, meanwhile, revealed that the project will involve using at least “6 tonnes of stored hydrogen to produce approximately 200 MWh electricity.” That power, presumably generated via hydrogen gas turbines, will be used “during times of high demand, and may be also used to make chemicals and other fuels,” it said.

NETL on Oct. 13 said that it plans to contribute to the project through several different areas of hydrogen research and development. Along with advising consortium members on gas turbine combustion of hydrogen-natural gas fuel blends, it will provide an independent performance assessment of the gas turbine co-firing demonstration. NETL will additionally “evaluate pipeline and distribution system component materials to assess degradation caused by blends of hydrogen and natural gas, which will lead to the identification of design selection and operational maintenance options to mitigate risk.” And, in collaboration with NREL and INL, it will attempt to quantify the benefits of hydrogen production and “assess opportunities for a broader build out of hydrogen generation and use.”

INL Doubling Down on Affordable Nuclear Hydrogen Production

According to Richard Boardman, director for Energy and Environment Science and Technology Programs Office at INL, U.S-based initiatives to explore nuclear hydrogen’s potential have focused mainly on industrial uses because the U.S. already has several existing hydrogen pipelines that feed industrial centers. “We believe that having central hydrogen plants based on electrolysis is going to be a great opportunity for us,” Boardman said as he presented a U.S. perspective during a “Hybrid Event” at the 65th International Atomic Energy Agency General Conference on Sept. 21.

Industrial uses may involve “putting a reactor down at the side of a petroleum refinery or near a petrochemical company. We’re working with some of those companies in the U.S.,” he said. “I wouldn’t be able to disclose them publicly, but we have a few million dollars of research going on at this time where we’re looking at putting these small- to medium-sized reactors right within industry, where they can be dedicated to making hydrogen.” A key focus is to minimize transportation and large-scale storage costs, he said.

However, INL is also looking into several other end-uses at its dedicated Dynamic Energy Transport and Integration Lab (DETAIL), Boardman said. The facility provides a “test environment” that enables simulations of coordinated, controlled, and efficient multi-directional distribution of electricity and heat for power generation, storage, and industrial end-uses. “We’re working on the ability to show that we can not only move between electricity production and hydrogen as demand response units but also help manage the grid quality of electricity by adjusting the frequency,” he said.

Pivotally, the innovative “connected” system is also delivering key insights into hydrogen costs. A key focus there has been to understand electrolyzer system integration. INL is currently working with European commercial electrolyzer stack producers as well as a full module from U.S.-based Bloom Energy, Boardman said.

So far, tests on at least one system have shown its stack can run successfully for more than 4,000 hours with little degradation. “That’s very encouraging to us because it signals to us that we’re ready, not just to go beyond LTE, but to couple the high-temperature electrolysis to these nuclear plants, with the confidence that these technologies are going to be durable for enough years that the economics of producing hydrogen will be good,” he said.

Progress at ongoing U.S. nuclear hydrogen production demonstrations is also encouraging, Boardman said. Exelon is now gearing up to install an INL-tested Nel Hydrogen electrolyzer at Nine Mile Point in January. Energy Harbor is meanwhile already making engineering changes to its four-unit Davis Besse plant’s switchyard, potentially allowing consortium partners to scale up an ongoing demonstration to “hundreds of megawatts,” he said. “This demonstration project … will be there for the benefit of teaching the operators how to control that plant, how that little small plant will integrate with the grid,” he said. Xcel Energy’s demonstration, which will use high-temperature steam electrolysis, will be “a full integration of both the steam as well as the electricity with a small module, but it’ll also set down the basis for us to go forward to scale up thermal integration.”

Boardman said the utilities are now also preparing to meet regulatory requirements associated with setting up “large hydrogen plants in proximity to nuclear plants.” In September, utilities met to organize two stakeholder groups: one will focus on regulatory needs, and the other will “actually engineer and tap into the thermal energy systems at these light water reactors [to take] large amounts of thermal energy [and] support the hydrogen production,” he said. Development of a conceptual design is underway. “We’ve already done preliminary probabilistic risk assessments for producing hydrogen within about half a kilometer of these nuclear plants. Everything seems positive for us going forward so far,” he said.

A Formidable Challenge: Meeting the Earthshot Hydrogen Cost Target

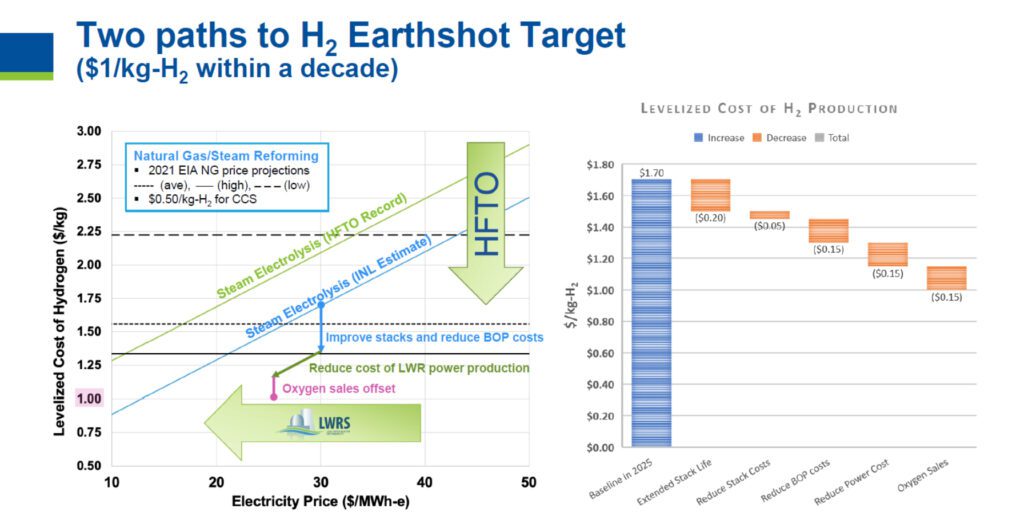

Perhaps the biggest challenge facing ongoing initiatives is to align to the Biden administration’s Earthshot goal, which calls for a reduction in the cost of clean hydrogen by 80% to $1/kg, Boardman said.

“There’s about $50 million being dedicated under [the Light Water Reactor Sustainability program],” he noted. “Our goal is to modernize [the nuclear fleet] to bring down their operating costs. Many of them already operate at $30/MWh, some even likely less than that. We hope to bring down [power production] costs to make them even more competitive, because after all, when it comes to electrolysis, the cost of electricity is the most dominant factor in the cost of hydrogen,” he said.

Along with targeted technology improvements, INL and other national labs are exploring high-volume manufacturing that will support drops in equipment costs. Improvements in stack lives could additionally bring down operating costs to about $1.70/kg of hydrogen. Other efforts will require reducing balance of plant costs and other power costs, as well as exploring sales of oxygen produced by the electrolysis process.

Boardman said INL is already working with stack vendors on producing oxygen independently from hydrogen production. “We’re hopeful this will come together within the next decade, and then we’ll truly achieve the Earthshot goal,” he said.

During a presentation for an event on the sidelines of the 65th International Atomic Energy Agency General Conference in September, Richard Boardman, director for Energy and Environment Science and Technology Programs Office at Idaho National Laboratory, suggested hydrogen production from U.S. nuclear light water reactors is on the right track to meet the Biden administration’s Hydrogen Earthshot Target of $1/kilogram within the next decade. Source: INL

During a presentation for an event on the sidelines of the 65th International Atomic Energy Agency General Conference in September, Richard Boardman, director for Energy and Environment Science and Technology Programs Office at Idaho National Laboratory, suggested hydrogen production from U.S. nuclear light water reactors is on the right track to meet the Biden administration’s Hydrogen Earthshot Target of $1/kilogram within the next decade. Source: INL

“But my final point is, we’re probably already competitive, especially when we take into account blue hydrogen and the cost of carbon capture and sequestration,” he said, pointing to the graph above. “That’s shown by the solid [horizontal] lines on the left. You can see for three different projected costs of natural gas in the U.S. and the cost of producing blue hydrogen, when I add only a cost of carbon of $50 per metric tonne, then that would increase the cost of blue hydrogen [by] about 50 cents/kg,” he said. “Therefore, these improvements will only make it more competitive, and we’re very excited about this.”

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).

Comments are closed.