The EU taxonomy alignment of natural gas and nuclear energy

The climate emergency, the ongoing war in Ukraine and its direct impact on the skyrocketing gas prices throughout Europe have made it clear that Member States and the Union must urgently shift to clean, cheap, and even national renewable energy sources.

Most recently, on the 20 of July, the European Commission proposed a new regulation and a Gas Demand Reduction Plan in order to reduce gas use in Europe by 15% until the spring of 2023 to face the natural gas shortage and dependence in the continent.

On the opposite direction, however, on the 6 of July 2022, the European Parliament voted to allow gas and nuclear energy to be labeled as green investments under the EU Taxonomy framework, meaning that these resources will now be considered sustainable and, consequently, suitable for Investment through ESG-labelled funds.

The Taxonomy Regulation is the center piece of the EU’s framework on growing sustainable investments in Europe and, alongside its delegated acts, plays a crucial role in the guidance of investors towards sustainable sectors by giving the financial sector (a certain level of) clarity on those economic activities than can be considered sustainable.

This classification was achieved through the majority vote of 328 Members of the European Parliament on the Commission Delegated Regulation (EU) 2022/1214 of 9 March 2022, amending Delegated Regulation (EU) 2021/2139 regarding economic activities in certain energy sectors and Delegated Regulation (EU) 2021/2178 concerning specific public disclosures for those economic activities (the “Delegated Act” or “THERE”), which is set to be a pragmatic proposal to ensure that investments in natural gas and nuclear energy, meet strict, defined criteria.

The DA has been plagued with much uncertainty, alleged lobbying by industry players and gas companies’ vested interests, and strong politicization by a couple Member States. First of all, the Commission did not hold a sustainability impact assessment nor a public consultation, like it did, for instance, with the functioning of the ESG factors in credit ratings. In addition to this, a joint meeting of the Economic and Monetary Affairs Committee and the Environment, Public Health and Food Safety Committee held on the 14th of June 2022 adopted an objection to the DA, reinforcing that any new or amended delegated acts should be subject to a public consultation and sustainability impact assessments, as they could have significant economic, environmental, and social impacts.

The “Green” Aspect

The sustainable aspects of, specifically, nuclear energyhave been argued for half a century, but when compared to other fossil fuels, such as natural gas, the lack of CO2 emissions has become a factor in this classification.

On one hand, natural gas is a fossil fuel and it produces planet-warming emissions, such as CO2. The key for labeling natural gas as a sustainable alternative is simply that is emits far less harmful emission than coal and is, therefore, a good temporary alternative to replace any other dirt fuel, while no other, truly sustainable alternative, is in place.

On the other hand, nuclear energy is completely free from CO2 emissions. As such, it is objectively less harmful to the environment than fossil fuels. But one cannot forget the damaging and outright destructive radioactive waste it produces and the horrifying consequences of its misuse – afterall, the principle regulating the use of nuclear energy, the Mass Assured Destruction principle, gives some hints on the importance of a careful and regulated use .

The adoption of the DA and its classification of nuclear and gas energy as sustainable proves to be problematic in the sense that the EU has always taken a science-based approach to the classification of sustainable activities, whereas this adoption highlights the political nature of sustainable development. That was done also by leaving sustainably-minded private investors and asset managers to their own devices to deal with the ever growing incoherencies and divergences between what is scientifically required to actively pursue climate change goals, and what the Member States and the EU set as climate change targets.

New Criteria for Nuclear and Gas Energy

In order to be classified as sustainable economic activities under the DA, nuclear and gas energy production must fulfill the following criteria (as examples):

- A threshold of 100g CO2/kWh for life-cycle greenhouse gas emission from the generation of electricity from nuclear energy and from fossil gaseous fuels;

- For fossil gaseous fuels, the gas facilities and plants must be designed and constructed to use renewable and/or low-carbon gaseous fuels and the switch to full use of renewable and/or low-carbon gaseous fuels takes place by 31 December 2035, with a commitment and verifiable plan approved by the management body of the undertaking;

- For nuclear energy, the construction and safe operation of new nuclear installations (new Generation III+ projects) for which the construction permit has been issued by 2045 by Member States’ competent authorities, in accordance with applicable national law, to produce electricity or process heat, including for the purposes of district heating or industrial processes such as hydrogen production (new nuclear installations), as well as their safety upgrades.

New Disclosure Requirements under Article 8 of SFDR

The new disclosure requirements through article 8 of the SFDR assist net-zero investors and asset managers with commitments to net zero emission goals, allowing for the easy identification of which funds have exposure to gas and nuclear energy and to screen sustainability-labelled funds whilst requiring large , listed companies to specifically report which activities and the proportion of which are linked more easily to nuclear energy and natural gas.

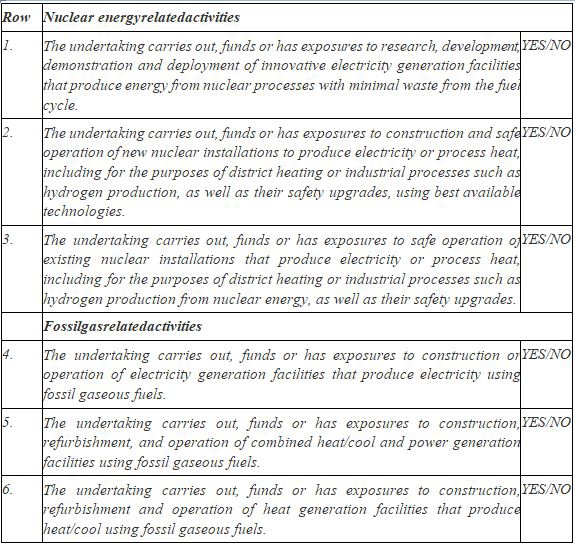

Template 1 Nuclear and fossil gas related activities

First, these new disclosures on gas and nuclear energy in the taxonomy alignment also means that the asset managers already complying with the Sustainable Finance Disclosure Regulation (hereinafter “SFDR”) must rethink and recategorize their already categorized and sustainable labeled funds.

Second, under the SFDR disclosure obligations of Article 8 and 9 SFDR, any investments made by asset managers must specify whether they are aligned with the economic activities set out by the Taxonomy Regulation. As such, the addition of nuclear and gas energy entails that asset managers will have to reassess their original disclosures, leading to legal uncertainty.

These new changes in disclosure requirements prove to be another obstacle for asset managers which were already endeavoring to use the taxonomy framework in order to evaluate the sustainable character of their funds and investment choices, translating into more data to be analyzed and processed(with the inherent limitations to its procurement and access) to it and difficulties interpreting the new criteria.

Conclusion

In trying to strike a balance between energy security and sustainability, the European Union has decided to label gas and nuclear energies in the taxonomy framework as transitional activities, in the sense that they help guarantee stable energy supply during the transition process to a sustainable economy and contribute to climate change mitigation under Article 10(2) of the Taxonomy Regulation.

Hopefully this represents a nudge for capital allocatorstophase outcoal “plays” in their portfolios.It is never enough to be reminded that, however, the road to carbon neutrality remains long and fraught with peril: Member States continue to be free to decide on their energy mix and investors may continue to invest as they wish, as there is no obligation on investors to invest solely in economic activities that meet such specific criteria.

Comments are closed.